“The aim of the wise is not to secure pleasure but to avoid pain ” – Aristotle

On 13th January 2020, Thailand became the first country outside China to report its first novel coronavirus infection. What started as a local issue in Wuhan, China soon became a global problem. Although it impacts on the long term health of individuals remain unclear, its impact on the world economy is obvious. We witnessed the Chinese economy grinding to a halt and supply chains collapsing. As the virus spread, major economies like India, the U.K., Japan, Germany suffered the same fate as the Chinese.

The military acronym VUCA – Volatile, Uncertain, Complex and Ambiguous – applies perfectly to 2020.

Across the globe markets, schools, stadiums are shut or partially open and people who can work from home are advised to do so.

As jobs and business are in deep trouble one question which is taking a lot of heat is. What will happen to my wealth? What does the future hold for my investments, savings and income?

It is not just financially inexperienced but experts working in financial and wealth sector are highly uncertain as to how the future will unfold and what would the world economy look like.

In normal times when the market is booming both, gold and gemstones may seem like good options, in fact, gems may have an upper hand, as gold tends to move slowly over time. But when times are hard, gold prices take an upward flight.

In this article, we would see some of the investment options available and what the future might hold.

The case for GOLD

By 600 BC coinage was invented in Lydia, what is now Turkey, which promoted gold to be used as a currency. In many civilizations ever since gold was either officially used as money, or used as a store of value. In Asia, the cradle of civilisation, gold and silver for millennia have played a dual role of ornamentation and of sound, reliable money which can be safely stored for future use. Additionally, it has been a safe haven for thousands of years.

While Asians have embraced inward investment from western and Japanese corporations, building factories and providing employment, they hang onto their savings, which are mainly in gold and silver, to preserve their families’ wealth.

Ordinary Indians and Chinese have retained the wisdom of their ancestors, despite attempts by successive governments to ban or discourage them from buying gold. Recently in the month of May and June 2020, Indian govt. launched gold bonds to discourage people from buying physical gold.

In terms of personal savings, we are always faced with a question of the value of our savings and its no surprise to conclude that the value of savings in plain currency form has been disastrous especially for middle class and poor who don’t have a substantial bank balance. World over all the currencies have been losing their value vis a vis gold for decades.

Let us take a look at how different currencies vis-a-vis gold have performed in the past half-century.

As we can see since 1969, relative to gold the Japenese yen has lost 92.8% of its purchasing power, the dollar 97.8%, the euro (and its previous constituents) 98.5% and sterling 98.9%.

In 1999 when the euro was launched it took 0.13 gram to buy one euro; today only 0.02 gram.

The Bundesbank (the German central bank) published a book in 2018 named Germany’s Gold. In the introduction, written by the President of the Bundesbank Jens Weidmann, he writes:

“Ask anyone in Germany what they associate with gold and, more often than not, they will say that it is synonymous with enduring value and economic prosperity.“

For individuals, it is safer to assume that personal possession of physical gold and silver bars and coins is best for wealth protection and future spending. It is a mistake to think that these two metals are just an investment alternative: they are money.

The major benefit that gold enjoys is the trust and awareness factor. From a simple villager to a high profile wealth manager, all recognize the value which gold holds. They are aware of the price prevailing in the market.

Gemstones (with exception of diamonds) are not very well known outside the jewellery industry, except Rubies, Emeralds and Sapphires. Even with Emerald, Ruby and Sapphire, most people are not aware of the value they hold and what quality is the best.

Walk into the office of an investment banker and tell him that you own a 5-carat red Spinel from Burma which equals pigeon blood in colour and can rival his best stock in return. His reaction will surprise you.

When the stock markets crash, investors flee to gold, causing the gold price to rise as stocks and gold are often negatively correlated. When economies contract and banks fail, gold offers the best protection. It’s the only financial asset that is no one’s liability.

Factors in favour of gold:-

1. Highly liquid and Open price

2. High awareness and universal acceptance.Can be sold in any city

3. Anyone can invest and earn some return. Even a 100 gram of gold bought by a mid to low income group person will fetch some return.

4. Can be used as collateral for a loan.

5. Gold has no counterparty risk

But investment in gold has some drawbacks as well.

Factors against:-

1. Risky to transport from one place to another. Try travelling on a flight with more than 10 grams of gold.

2. Needs permanent safe storage.

3. Price of gold increases at a very slow pace.

What the future holds?

When the economy of different countries will contract or deflation(prices of general goods and services fall due to less demand) occurs, all the central banks will hand out cash by lowering their interest rates. To encourage exports some countries may devalue their currencies.

Other than that there is a sign of a double-edged problem every economy is facing which is-

1. Companies aren’t making ends meet

2. Banks face insolvency due to non-repayment of loans as businesses go bust.

This brings us to the current situation, where the expansion of the quantity of money in all major currencies will increase massively in an attempt to control the economic consequences of the coronavirus.

Till now the US has declared a trillion-dollar package, Thailand $58 billion, India $200 billion, Japan $240 billion, China $500 billion, Singapore around $90 billion and Malaysia $63 billion etc.

Nearly all the countries of the world will be pouring in billions of dollar in their economy in days to come. This will have 3 consequences in future:-

1. Hike(inflation) in the general price level of goods in the long term.

2. Gold price will surge even further as the value of the currency goes down.

3. Uncertainty about the future will push people to park money in a safe and liquid investment. In this case, gold.

The future prospect of gold seems bright although there may be some price correction after pandemic ends and economies get back on track, but when will that happens is anyone’s guess.

Now let us focus at the case for gemstones as an investment option.

The case for gemstones

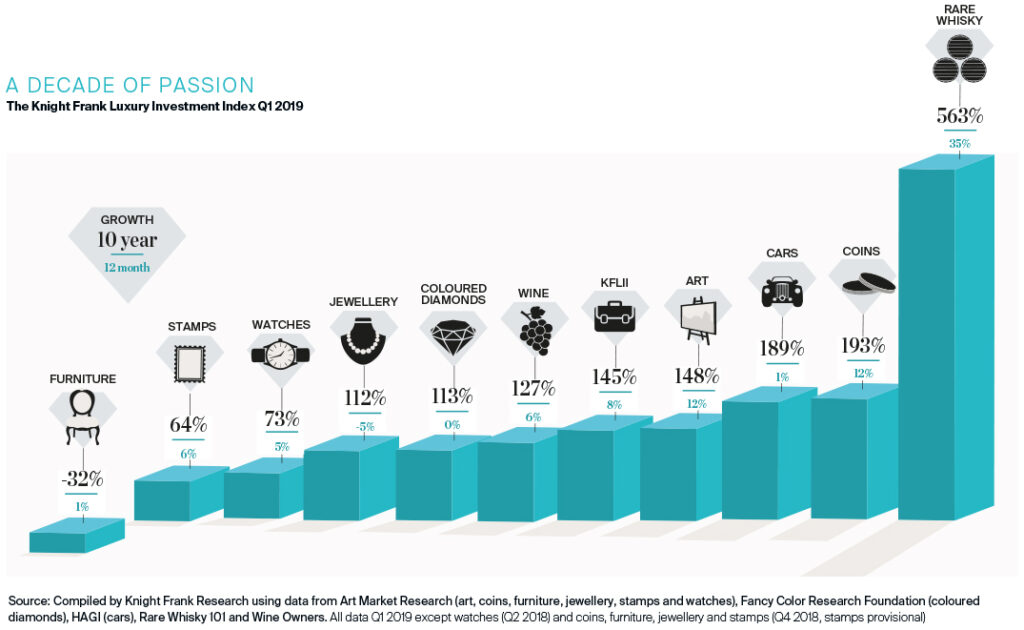

In the past decade(2010-2019) coloured gemstones have seen a surge in its prices due to heavy buying by High Net Worth Individuals. The return given by top-quality colour stones has been more than 100% according to Luxury Investment Index prepared by Knight Frank.

The primary factor contributing to renewed interest in colour stones were the following:-

1. Increase in the number of High nets worth individuals in the Asia Pacific region especially in India, China and Hong Kong.

2. More availability of gem labs resulting in more transparency.

3. Consumer awareness via the internet and other social media.

4. Vibrant markets.

Interestingly as compared to fine coloured diamonds or jewellery, giving a return of around 100%-125%, rare Whisky gave a return of 563% in 10 years. (Cheers !!!!!) We shall see that later in this article.

According to Luxury Investment Index, published by Knight Frank in 2019, it is important not only in terms of where the gemstones are being mined but also in where the demand is coming from. “Fabergé is seeing increased demand from Asia in particular for rubies,” says von dem Bussche-Kessel, global sales director at Faberge. “There, the colour red represents good luck, fortune and mystery.”

But one thing on which many traders agree: synthetic stones won’t ever replace their natural counterparts. As Stephan Reif director of International coloured stones puts it in the same report published by Knight Frank Luxury Investment Index: “No technology could replace the magic and fascination of natural coloured gemstones.”

Factors in favour of gemstones:-

1. High return

2. Due to awareness among the public via social media platforms, demand has gone up in recent times.

3. Easy to carry. 5-6 pieces of top quality Rubies can easily be carried even on flights.

Factors against:-

1. Determining the price of gemstones is a tricky issue.

2. As an investment option its only for HNI’s or Ultra HNI’s. If someone wants to invest 1000-5000 USD he better chose some other asset.

3. Not everyone investing in gems will get a return. Only top quality stones like pigeon blood Ruby, Muzo Emerald, Kashmir or Burmese sapphire with royal blue colour will fetch handsome return.

4. Difficult to liquidate when the economy is in bad shape as it is difficult to find a buyer. In some cases, the return value may fall.

5. Place of selling matters. The person needs to be in Hong Kong, Jaipur, London, Paris, Newyork, Shanghai or Bangkok to sell expensive stones unlike gold which can be sold even to relatives, friends and in any city.

What the future holds

Although the price of gemstones will see a fall due to less demand in the jewellery sector, as more and more people cut back on their spending. But top-quality stones will continue to fetch good returns.

Case for coloured diamonds

“A diamond is forever“. We know this quote thanks to the genius of young copywriter of N.W Ayer advertising agency Frances Gerety. This marketing campaign launched in 1977 is a case study at many business schools and is considered as the best advertising slogan of the 20th century.

Diamonds graded as Fancy can come in 3-4 colours. Brown is the most common, yellow is notably rare, and most other colours, including blue, pink and red, are considered the rarest.

According to data published by the Fancy Color Research Foundation (FCRF), over the past decade (2010-2019) the Fancy Color Diamond Index showed a steady market price increase of 77%. Leading the index during the decade were Pink diamonds, which increased by 116%. The prices of Blue diamonds rose by 81% and of Yellow diamonds by 21%.

An interesting thing to note is that diamonds of rare shapes achieved good results in Sotheby’s Geneva Magnificient Jewels and Noble Jewels sale in June 2020. A marquise-shaped 7 carats,fancy-intense pink diamond ring sold for $2.8million US at Sotheby’s first live auction since coronavirus. A pear-shaped 5.29-carat fancy grey-blue diamond ring fetched $2.1 million U.S. The main reason for these diamonds fetching high price is because it is very tough to derive colour form pear shape than radiant or a cushion cut diamond.

Although the price for yellow diamonds has taken a hit, yellow diamonds performed well as declining prices made them more accessible to the end client.

What the future holds

Although we may see a dip in sale of fancy diamonds in 2020-2021, it’s medium to long-term prospects still looks good due to its rarity factor. In 10 year period (2010-2019) fancy diamonds have given nearly 113% growth rate as can be seen in the picture below

A piece of dampening news for the fancy diamond market is that Argyle Diamond Mine in Australia, a source of over 90% of pink diamonds in the world, is set to close by 2020. But this may lead to a supply of pink diamonds entering the market from private owners, all of whom will be hoping to cash in because of the reduced supply.

Case for Whisky

Whisky is not only for whisky lovers but also for collectors and investors. Buyers often stockpile expensive whisky and use it as a gift for business partners. Investors simply store these valuable bottles for several years and as their value increases, they are sold for a profit.

Many investors stick to well known and high-valued Scotch whisky brands like Macallan, Highland Park, The Balvenie, Glenmorangie, Ardbeg, and Bowmore.

The Rare Whisky Apex 1000 index which tracks the best 1000 bottles of whisky has appreciated by 162.91% since 2014, outstripping gold by over 150% and the FTSE(Financial Times Stock Exchange-An index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation) by over 160%.

Rare Whisky 101 has also created an index of the 100 most valuable whiskies which can give you an idea of what the market currently considers collectable for Scotch whisky, American whiskey and many others from around the world.

Data compiled by Rare whisky 101 shows that in last one-decade rare whisky has witnessed a 580% increase in value.

In fact, for the last 10 years or so, single malt whiskies aged between 25 and 60 plus years have proved to be one of the best investments money can buy.

As can be seen in the picture rare whisky price has witnessed a 563% growth over a 10 year period much higher than jewellery (112%)or coloured diamonds(113%) or it’s near rival which is coins(193%).

A bottle of Macallan 1926 fetched a staggering amount of £1.5m at an auction held by Sotheby’s in London in October 2019. In the same year in April 2019, Bonhams London auctioned a 17.43-carat Kashmir sapphire ring that fetched £723,063.

Bonhams also set a record for 54 bottle set of Hanyu Ichiru Malt Full Card Series when it sold this collection for £755000 at its Fine and Rare Wine and Whisky sale in August 2019.

If you had purchased an 18-year old vintage Macallan in 2015 it would have cost somewhere around £19,000. By 2016, the same whisky was worth about £46,000 a bottle giving you a profit of £27,000.

No other asset class comes close to 10-year growth according to Knight Frank Rare Whisky Index.

Investing in whisky might seem appealing, given the returns that you can potentially make, but it’s a challenging business and there are lots of things that will determine your success.

Following are the risks associated with investing in whisky:-

1. Vulnerable to market forces

2. You might choose a bad whisky that doesn’t increase in value.

3. You may feel the urge to drink it.CHEERS!!!!

How to deal in whisky

Whiskies are often sold at the auction houses, private sale or online. For people willing to invest in whisky, WhiskyInvestDirect* and rarewhisky101* can prove to be useful sites to visit.

Conclusion

Although it’s tough to choose one investment option over the other but with a little bias towards gold due to its historical significance and role played by it in every economic crisis, I would say it provides decent insurance during tough times which no other investment can deliver. On top of it, gold requires the least amount of knowledge or skill to benefit from its use.

(* Names are written purely for informational purpose and are not part of any paid promotions)